Risk Index: Embroker’s 2022 Startup Risk Report

2022 has been a year of increasing challenges for startups. Read our risk index and get the latest details on how founders are responding to risks.

2022 has been a year of increasing challenges for startups. From geopolitical disruptions such as the war in Europe and consequential volatility in the markets, to higher inflation and rising interest rates, there’s been no shortage of risks that have disrupted the day-to-day operations and fundraising plans of startups in the tech sector and beyond.

But, how are startup founders and business owners responding to all this risk? The 2022 Embroker Startup Risk Index Report set out to answer this question by surveying 500 VC-backed startup founders in the U.S. The report reveals how startups embrace risk to drive growth and which risks most threaten future growth. The insights highlighted in the report aim to prepare founders for the challenges they are facing in this unprecedented risk environment.

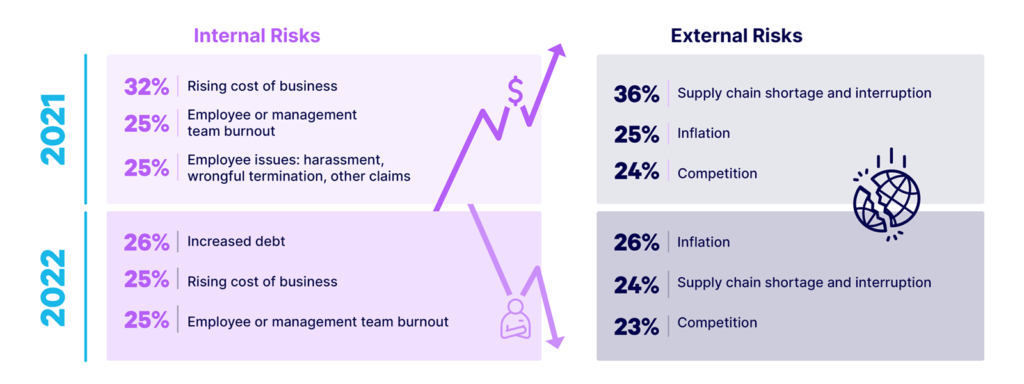

Among its findings, the Risk Index Report reveals that when it comes to business risks, operating capital and costs are foremost on the minds of founders. 26% of founders identified increased debt as the top internal risk, followed by the rising cost of business (25%) and employee or management burnout (25%). The top external risks for 2022 were inflation (26%) and supply chain issues (24%, down from 36% last year).

Faced with all these growing internal and external risks, founders identified three primary strategies: help from advisors (32%), controlling growth (30%), and prioritizing risks (30%).

Risk Index Report: The Findings

The report reveals that when it comes to business risks, operating capital and costs are foremost on the minds of founders. 26% of founders identified increased debt as the top internal risk, followed by the rising cost of business (25%) and employee or management burnout (25%). The top external risks for 2022 were inflation (26%) and supply chain issues (24%, down from 36% last year).

Faced with all these growing internal and external risks, founders identified three primary strategies: help from advisors (32%), controlling growth (30%), and prioritizing risks (30%).

The Risk Index Report also highlights the difference between personal and business risks that founders must take as they run their organizations and seek funding.

We found that founders are willing to take on personal risks to support their startup, but only up to a certain point. 33% of founders surveyed said they are willing to put aside their personal pride to help their startup. At the same time, a similar percentage claimed they would not take on any risks that would harm their reputation.

These results highlight the fact that founders are willing to sacrifice their egos and compromise on their vision to help their business, while at the same time trying not to risk their reputation or business relationships in the process.

However, founders have a complex and at times contradictory relationship with risk. When asked directly about risk, 63% of founders consider themselves to be “risk-averse.” However, an even greater majority (65%) admit that risk is a necessary part of doing business and growing their startup.

It’s clear that, while founders are aware of the challenges that come with various kinds of risk, they also want to be open to the kind of risk-taking that startups need to innovate and grow.

The results of theRisk Index Report highlight the importance of insurance literacy among founders. Given the sheer number of internal and external risks that founders face, having the right insurance coverage is one of the most effective ways of protecting their business, particularly in the current economic environment.

Part of that literacy is understanding what kind of risk taker you are. As a business owner, being risk averse or risk prone can have major benefits and consequences to your operations, depending on how you deal with it. But, how do you know what kind of business owner you are?

Along with our Risk Index Report, we’re also launching the Risk Archetype Quiz.

In this quiz, you’ll be asked a series of questions to learn how to calculate business risk and to help determine what type of risk taker you are. By learning how risk averse or risk prone you are, you can better understand your behaviors as a business owner and individual, as well as create strategies to keep yourself and your organization protected.

Specifically, knowledge of insurance includes directors & officers insurance (D&O) to protect the leadership of the company, including owners.

Faced with the current uncertainty in the tech sector, startup leaders should also look into employment practices liability insurance (EPLI). Layoffs are an unfortunate and painful part of any downturn, and having EPLI coverage can help protect a business faced with employment-related issues during such challenging periods.

Creating an effective risk management plan is crucial for identifying and combating potential risks that businesses face. For startups, Embroker’s Startup Package provides an essential group of insurance policies to cover your business, including cyber liability insurance, which is a must for any tech company.

Embroker’s 2022 Startup Risk Index shows that risk is an inevitable part of starting and running a business. Many of the challenges that VC-backed startups are currently facing are set to continue for the rest of the year and into 2023.

For that reason, founders have to learn how to manage and respond to such risks and look for ways to mitigate them.

To learn more about what startup founders think about the personal and business risks they’re facing, their views on investor expectations and demands, and which risk profiles founders identify with the most, download the full Risk Index Report.

If you want to learn more about the best coverage for your business, please visit Embroker’s digital insurance platform.