Free LLC Tax Calculator + How to File LLC Taxes

The IRS considers LLCs “pass-through entities,” which means that, for tax purposes, the LLC isn’t considered a separate entity from the individual who owns them. Therefore, the LLC's income should be reported on the individual’s federal tax return.

This also means that an individual owner of an LLC is personally liable for any costs, fees, or damages a company incurs. If an LLC is sued and doesn't have the funds to cover the damages, then the court can seize its owners' personal assets. So if an LLC doesn't have adequate insurance, an expensive lawsuit could not only cripple the business, but it could also rob the owners and their families of their homes and security.

Use the LLC tax calculator below to find out what your company will owe this tax year. Keep in mind that this is an estimate, and you should always have your LLC's taxes filed (or at least reviewed) by a certified tax preparer. Our calculator also doesn’t take into account any dependents or other individual tax credits that owners may be eligible for, like the Earned Income Credit or student loan interest deductions. These calculations pertain to the taxation of LLC business income only.

LLC Tax Calculator

Results

Federal Taxes:

Federal Income Tax

$ {{ federalIncomeTaxFormatted }}

Social Security:

$ {{ ssaTaxFormatted }}

Medicare:

$ {{ medicareTaxFormatted }}

State Taxes

State Income Tax:

$ {{ stateIncomeTaxFormatted }}

Additional State Taxes: (Ex. Franchise Tax, etc)

$ {{ stateAdditionalTaxFormatted }}

Total Taxes

$ {{ totalTaxesFormatted }}

What Types of Taxes Do LLCs Have to Pay?

Businesses are subject to many different types of taxes at both the state and federal levels. Additionally, businesses are responsible for transferring the taxes withheld from employees' paychecks to the government throughout the year.

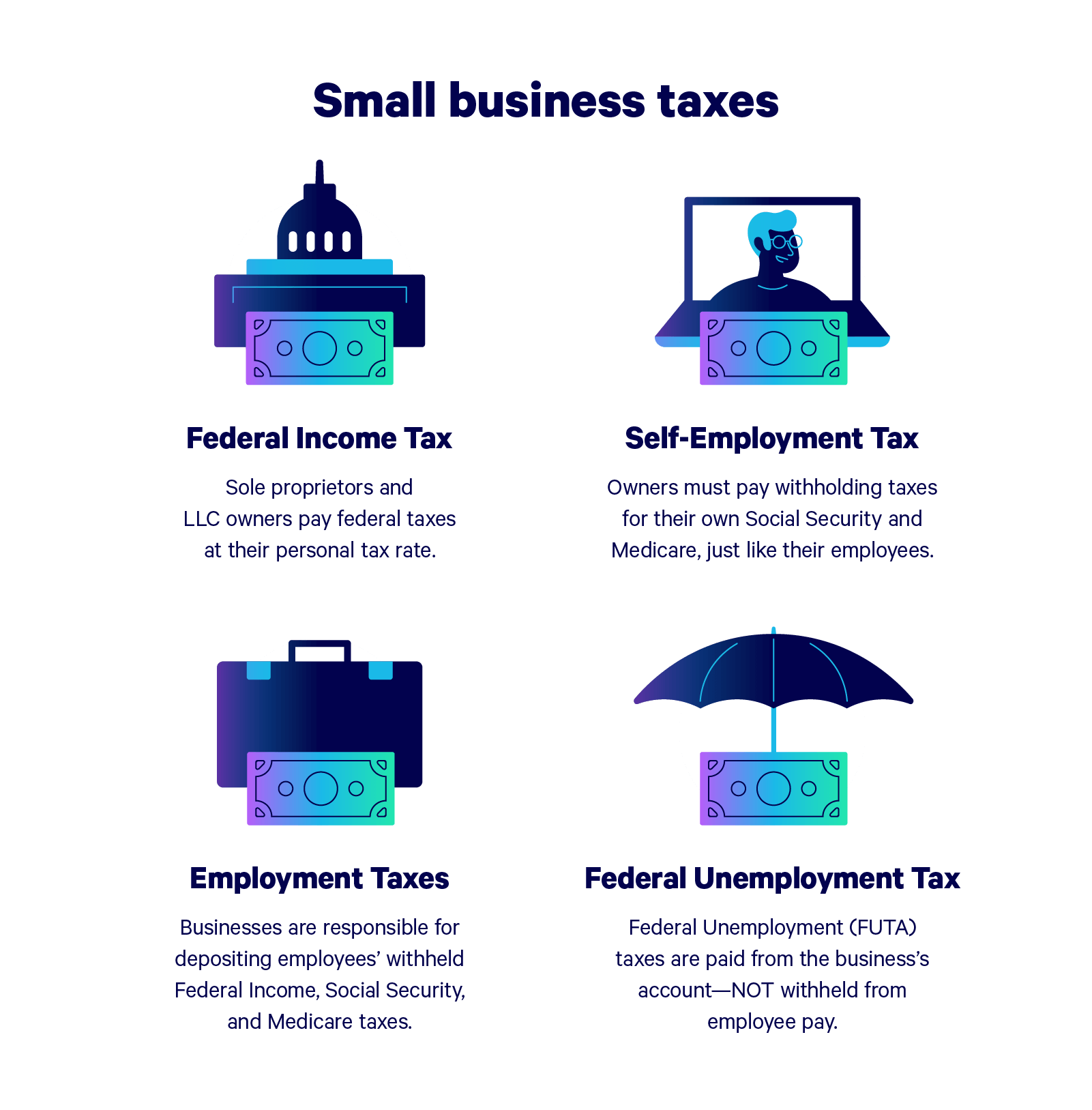

Federal Taxes

There are four types of taxes that an LLC may see at the federal level: income tax, self-employment tax, federal unemployment tax (FUTA), and excise tax.

Federal Income Tax

The business owner files federal income taxes for LLCs as personal income on their individual tax return. If an LLC has two or more owners, each owner is responsible for a percentage of the business's income equal to the percentage of the business that they own.

For example, two founders with equal ownership would each report 50% of the company's income. If one founder owns 60% of the company and the other owns 40%, Founder A will report 60% of the income, and Founder B will report the remaining 40%.

Self-Employment Tax

In addition to the LLC's overall income taxes, owners must also file Social Security and Medicare taxes for themselves as an individual. These taxes are known as "self-employment taxes." Every owner or co-owner must file their own self-employment taxes.

Federal Unemployment Tax

All businesses with employees need to pay a federal unemployment tax — or FUTA. Federal law requires businesses to contribute 6% of the first $7,000 that each employee earns in a calendar year. For any employee earning $7,000 or more, the FUTA contribution is $420.

Excise Tax

Lastly, all businesses are subject to excise tax (another term for a sales tax). However, only some items get taxed at the federal level. Typically, sales tax is collected and paid to the state.

Federal excise taxes get collected for sales of things like fuel, tires, tobacco, indoor tanning, and a handful of other assorted goods and services. You can find out whether your LLC is subject to federal excise taxes on the IRS Excise Tax site.

Unlike the first three categories of federal taxes, filed annually, excise taxes are paid periodically throughout the year (usually quarterly).

State Taxes

There are three types of taxes that an LLC may be required to pay at the state level: state income tax, sales tax, and state unemployment (SUTA). Additionally, some states collect a fourth type of tax — typically called a franchise or business entity tax.

State Income Tax

In most states, LLCs must pay income taxes to the state as well as the federal government. Just like federal income taxes, if a business has multiple owners, each owner reports the income for the portion of the business they own.

There are nine U.S. states that have no income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Since LLCs are taxed as individual income, LLC owners in these states do not pay business income taxes, either.

State Unemployment Tax

Like income taxes, businesses must pay unemployment taxes at both the state and federal levels. But whereas FUTA is a fixed percentage for all businesses, state unemployment rates vary widely. Each state sets a different state employment range, and then each business pays a percentage within that range. A number of factors determine a business’s SUTA rate, including industry and how many past employees have received unemployment benefits.

State unemployment tax is paid by the employer, not by the employee. The only exceptions are Alaska, New Jersey, and Pennsylvania, where employees are required to contribute to SUTA alongside their employers.

Additional State Business Taxes

Thirteen states — as well as Washington, D.C. — collect an additional business tax. Each state calls this tax something different, but it's typically something like "franchise tax" or "business entity tax."

Below is a list of states that charge additional business taxes, what the tax is called, and how the tax amount is determined.

- Arkansas: Franchise Tax, flat $150 annual fee

- California: Franchise Tax, progressive tax rate determined by total income

- Connecticut: Business Entity Tax, flat $250 fee owed on odd years only

- Delaware: Business Entity Tax, flat $300 fee

- D.C.: Business Franchise Tax, fixed rate of 8.25% of net income

- Illinois: Personal Property Replacement Tax, fixed 1.5% of net income

- Kentucky: Limited Liability Entity Tax (LLET), $.095 per $100 of gross receipts (business income plus sales tax); only applies to companies earning $3 million in gross receipts or more

- Minnesota: Minimum Fee applicable to businesses with $500,000 in property and sales

- New Hampshire: Business Profits Tax, fixed 8.2% of net income

- New York: Filing Fee, progressive rate determined by net income

- Ohio: Commercial Activity Tax, fixed .26% of gross receipts in excess of $1 million

- Rhode Island: Business Corporation Tax, flat $400 annual fee

- Tennessee: Franchise Tax, fixed .25% of LLC's net worth

- Vermont: Business Entity Tax, flat $250 annual fee

Note that these rates are for LLCs, and may differ for businesses structured differently.

Employee Withholding Taxes

In addition to federal and state taxes, LLCs are also responsible for transferring the taxes subtracted from their employees’ paychecks to the government. These taxes come from employees' income, not the business', so they aren't "business taxes." However, the LLC is still responsible for making the payments. Additionally, withholding taxes need to be paid once per quarter, rather than annually.

Tax Deductions for LLCs and Small Businesses

Since LLC taxes are like personal income taxes, they’re subject to the same rules regarding tax deductions. Individuals can choose the standard deduction or, if their tax-deductible expenses are higher than the standard deduction, they can itemize their deductions.

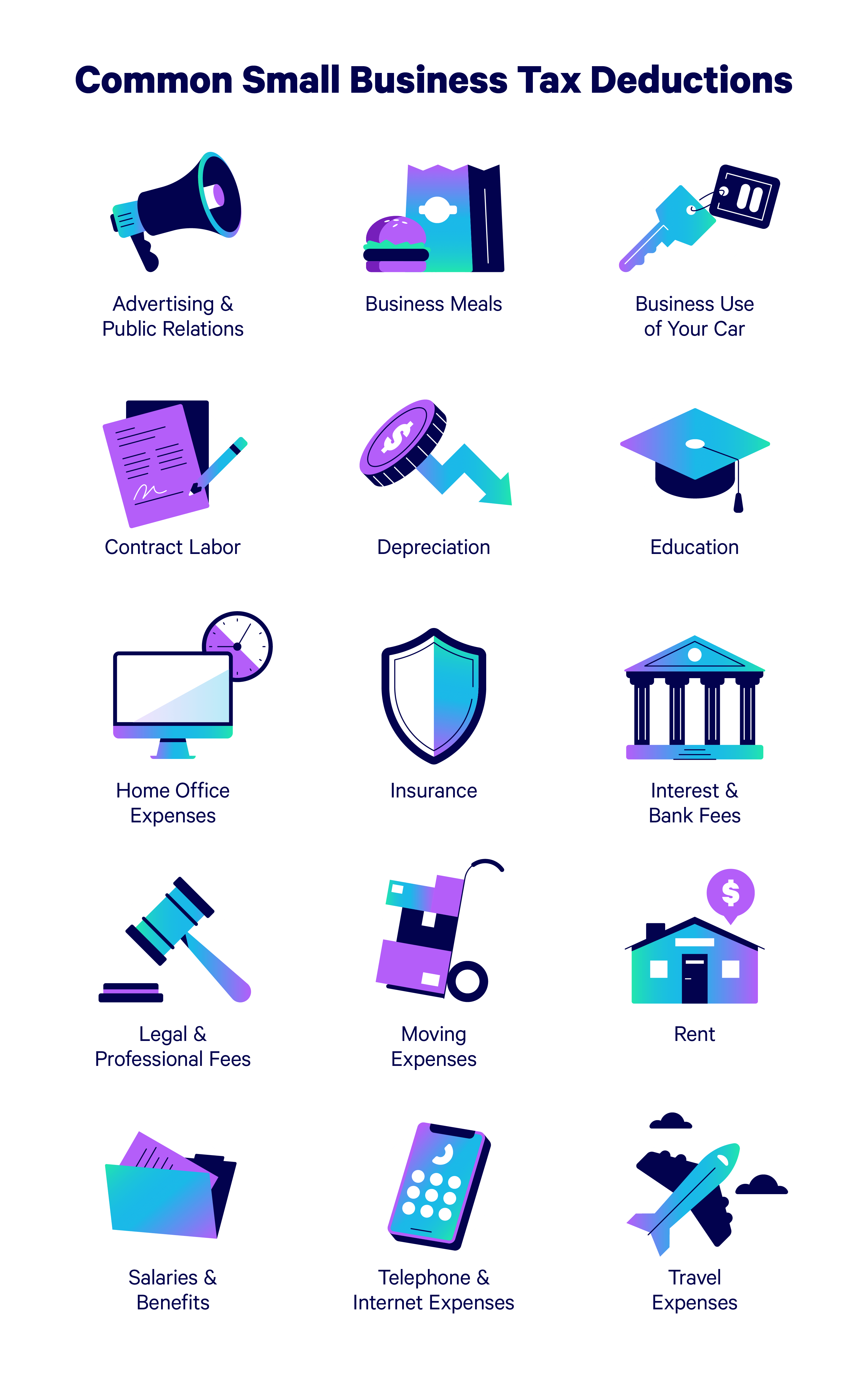

Small business owners can deduct the same personal deductions that individuals can, like charitable contributions and student loan interest payments. Additionally, there are 15 common deductible business expenses from most LLCs’ taxable income. They are:

- Advertising and PR expenses

- Business meals

- Business use of a vehicle

- Contract labor

- Depreciation of assets

- Education

- Home office expenses

- Insurance

- Interest and bank fees

- Legal and professional fees

- Moving expenses

- Rent

- Salaries and benefits

- Telephone and internet expenses

- Travel expenses

The only expenses in these categories that are qualified tax deductions are business expenses. For example, one could not deduct their personal tuition, even though "education" is a business deduction category. However, there are some exceptions for those self-employed individuals who work from a home office.

Home Office Deductions

If a self-employed LLC owner does their work from their home, they may be able to deduct a portion of their home costs as business expenses.

To qualify for these deductions, the individual must have a separate and distinct office area used exclusively for business purposes. Someone who permanently converted a spare bedroom into an office can deduct their home office expenses. However, someone who works from a laptop at their kitchen table would not be eligible for the same deduction. Additionally, full-time employees who work remotely from a home office cannot deduct their home office expenses.

Deductible home office expenses include:

- Office equipment

- Paper and supplies

- Cell phone, internet, and utility expenses

- Home or renters’ insurance

- Real estate taxes

- Qualified mortgage insurance premiums

- Qualified mortgage interest

- Property and equipment depreciation

If an expense affects the entire home, like wifi costs and home insurance, only a portion of that expense is tax-deductible. To calculate what percentage of these expenses you can deduct, determine what portion of the house is occupied by the home office by dividing the square footage of your office by the square footage of the home. Record the resulting percentage as a business deduction.

Though our calculator will provide you with a close estimate of your business's tax liability for the year, some more complicated taxes can only be calculated accurately by a tax preparer with in-depth knowledge of your specific state's tax requirements. Even if you hire a qualified tax preparer, however, mistakes still happen, which is why it's important to ensure you're only hiring financial professionals with an Accountant Professional Liability or Errors and Omissions insurance policy. In case a mistake results in a tax audit by the IRS (which may also come with a hefty fine), these policies will ensure that neither your company nor the tax preparer is liable.

No matter how familiar you are with them, taxes are extremely complicated and oftentimes stressful. Protecting yourself with insurance is the easiest way to alleviate some of that stress by ensuring that you're covered no matter what.