16 Business Expenses That Startups Waste Their Money On

Here is a list of 16 common business expenses (broken into three categories) that startups very often waste their money on. Read more.

Table of Contents

- Business Management Expenses

- HR Expenses

- Marketing Expenses

- How to Create a Sustainable Growth Strategy

Protect your business today!

Get a QuoteProtect your business today!

Get a QuoteThere’s no way around it: in business, you have to spend money to make money. And this mindset works, because according to data collected by Crunchbase, the more money startups raise, the more likely they are to see a bigger exit.

So how is it also possible that the second most common reason startups fail is because they run out of cash?

While it’s certainly hard to build something new without the resources to do so, “spending money to make it” only works if you’re spending on the right things. And if you’re not, it hurts you twice — once because you wasted your money and a second time because you now have less to spend on the things that actually help you grow.

So to help you use your precious funding wisely, here are 16 business expenses (broken into three categories) that startups often waste their money on.

Business Management Expenses

Many expenses are strategic in nature, meaning they’re a failure of mindset or perspective by leadership. Here are five of the most common ones:

1. Expensive Office Spaces

Offices are very, very expensive — anywhere from $1,200 to $12,000 per employee annually (not including salary) depending on the city you’re located in.

So if you’re a startup that can function without one (i.e. remotely), doing so is a smart financial move…especially when you consider the additional benefits that working remotely is proven to provide.

Tip: Build a Distributed Workforce

This is especially important during and in the aftermath of the COVID-19 pandemic, where many businesses have to work from home anyway. And using your funding to buy quality digital communication tools now will help you invest the money you would have spent on your office in activities that grow your revenue instead (marketing, sales, etc.) once quarantine is lifted.

2. Cut-Rate Short-Term Solutions

When you’re on a budget, it’s easy to get into the mindset of doing what is cheapest right now to save money. However, doing this may mean you have to spend even more in the long run in some instances.

Software development is a great example. Some development companies are cheaper than others. But that’s because you can build the same piece of software in multiple different ways. And many non-technical founders often don’t realize that some of those ways could mean you’ll have to completely rebuild your product in the future as you grow, costing you significantly more than if you had spent a little more to build it the right way the first time.

Tip: Prioritize Measurably Better Long-Term Solutions

If you’re faced with a decision, it’s better to spend more now on the things that will build a measurably better foundation for the future than it is to cut corners now for the sake of saving a buck. Just make sure it is actually measurable before you spend on it (meaning you can quantify how it will save you money in the future).

3. Expensive Tools

Software and tools can account for a huge proportion of the average startup’s expenses (for example, over 10% for this one). But far too many startups either buy tools they don’t need or buy tools that are bloated with features they don’t use.

The reality is, the “best tool on the market” is often designed with large enterprises in mind (meaning when you’re small, it’s likely overkill). So it’s often better to purchase something that’s better suited to a business of your size.

It may be a little less sexy, but it will save you a fair amount of money while still being equally as effective.

Tip: Only Purchase What You Really Need

Only spend money on tools that are essential to producing revenue. Use the free versions of things if possible and only upgrade once you have the revenue stream to justify it or if the additional features are essential to your business.

4. Premature Scaling

The larger you grow, the larger your problems become, and the harder it is to fix them. That’s why many startups who scale too quickly fold almost as fast — they grow so quickly that they incur massive technical debt.

For example, purchasing office space before you have employees to fill it or building production capacity before you have enough customers to buy what you’re selling are both common reasons many startups fail.

Others include scaling customer acquisition before you’ve found product market fit (too many leads that aren’t the right fit) or even funding (too much cash increases the likelihood of spending it unwisely).

Tip: Scale In Response To Demand

It’s better to scale your business in response to demand rather than in expectation of it. So early on, spend your money on finding product market fit rather than growing in size. You’ll scale more efficiently with less likelihood of collapsing later if you approach it this way.

5. Bad Accounting

It’s surprisingly easy to grow an unsustainable business without realizing it if you’re not tracking your expenses properly. Today’s venture capital model makes it easier than ever to grow a unicorn startup that’s unprofitable. In fact, In fact, first quarter of 2023 is experiencing a freeze which is the largest class of unprofitable IPOs since the DotCom era CNBC.

That’s why solid accounting might be one of the most important things you invest in as a startup. Without it, it’s too easy to build something that will never run without cash infusions or waste a lot of money in the wrong places.

Tip: Hire a Good CFO or Accountant

Even if you’re super early-stage, spend the money to hire a talented accountant or CFO who can make sure you’re actually running a sustainable business. If your budget can’t facilitate these hires at this point, utilize technology to help. Making sure your bookkeeper has the right accounting tools can go a long way towards minimizing the chances of human error and enhancing financial transparency.

If you don’t have an accurate picture of where your funding is being spent, the likelihood of wasting it goes way up.

HR Expenses

Labor costs are an enormous part of your overall business expenses. In fact, in some business models, they can account for up to 70%. Here are six HR expenses that startups often incur erroneously.

6. Hiring Prematurely

Many startups make the mistake of hiring unnecessary or underutilized personnel when they’re trying to get a revenue stream going, especially when hiring revenue-generating roles like marketing and sales.

But since the true cost of hiring an employee full-time is often 1.25x to 1.4x their salary (and since paying your people is one of your biggest expenses) hiring them too quickly just burns cash faster than you need to.

Tip: Contract Work Out

Can you contract this work out for now? Can you hire someone part-time for it? Think about what will be the most cost-effective and before you make a full-time hire, make sure you’ll have full-time work for them.

7. Overhiring

Many startups overhire with the thought of being prepared for a rapid expansion. But just like hiring team members prematurely will drain your funding faster than you want, hiring too many people will have the same effect. Being understaffed is stressful, but running out of money prematurely means game over.

Tip: Hire In Response To Demand

Finding the right balance between understaffed and overstaffed is tricky. But it’s better to err on the side of understaffed than overspend on people you don’t need.

Keep an eye out for burnout or drops in output and communicate with your team to assess whether it’s time to hire additional help. Or opt for contract or part-time employees in the interim and scale to full-time when you’re ready.

8. The Wrong Hire

The Boston Consulting Group found that quality recruiting has the greatest impact on revenue growth and profitability. This means making the right hire might be one of the most important things you can do if you want to grow.

Not only could the wrong hire impact growth, but it can also cost you an incredibly large sum of money — anywhere from 50% to 250% of a person’s annual salary depending on their role.

Tip: Quality Hires Only

When you’re ready to hire, it’s worth spending the time and money to get it right. Even if the pressure to “get someone now” is real, the most important thing you can do is to find the person with a proven track record of producing the results you want to achieve who also believes in your company’s mission.

It will cost you in the short term to hire this person, but if they really are the right one, it will pay off big in the long run.

9. Lavish Employee Perks

Perks and benefits (like a ping pong table or a kegerator) are nice for attracting recruits to your startup. But they don’t build culture by themselves. And when you’re a small company with limited runway, there are a lot better (and more cost-effective) ways to do so.

Tip: Connect Employees To Your Mission

When you’re hiring team members as a young business, focus on hiring those who believe in the mission of your company. Show them why their work matters and that you care about their success.

These things will attract more talented recruits, build a stronger culture, and reduce turnover better than free LaCroix.

10. Expense Reimbursements

When VC money is flowing and things are loosely defined, it’s easy to get in the habit of expensing meals, entertainment, etc. Some startups even take this to the extreme, throwing lavish parties or even expensive vacations.

Needless to say, this burns cash much quicker than you need to if you’re really serious about building a sustainable business.

Tip: Document Your Reimbursement Policy

To ensure you and your team don’t go overboard on expense reimbursements, it’s best to write out your expense policy from day one and give everyone a copy — even if you’re just two or three people. This gets everyone on the same page and sets a precedent to follow as you grow.

11. Business Travel

Similar to business expense reimbursements, business travel is another item that often gets away from startups easily for startups. When you get those first few clients, it’s tempting to hop on a plane and go see them in person. However, this is often unnecessary.

Tip: Use Digital Communication Tools

The digital communication tools we have available to us today are more than sufficient for connecting with clients, especially right now during the pandemic when travel is risky anyway. Is an hour-long meeting worth a $1000 plane ticket when you could have that same meeting with a video call for free?

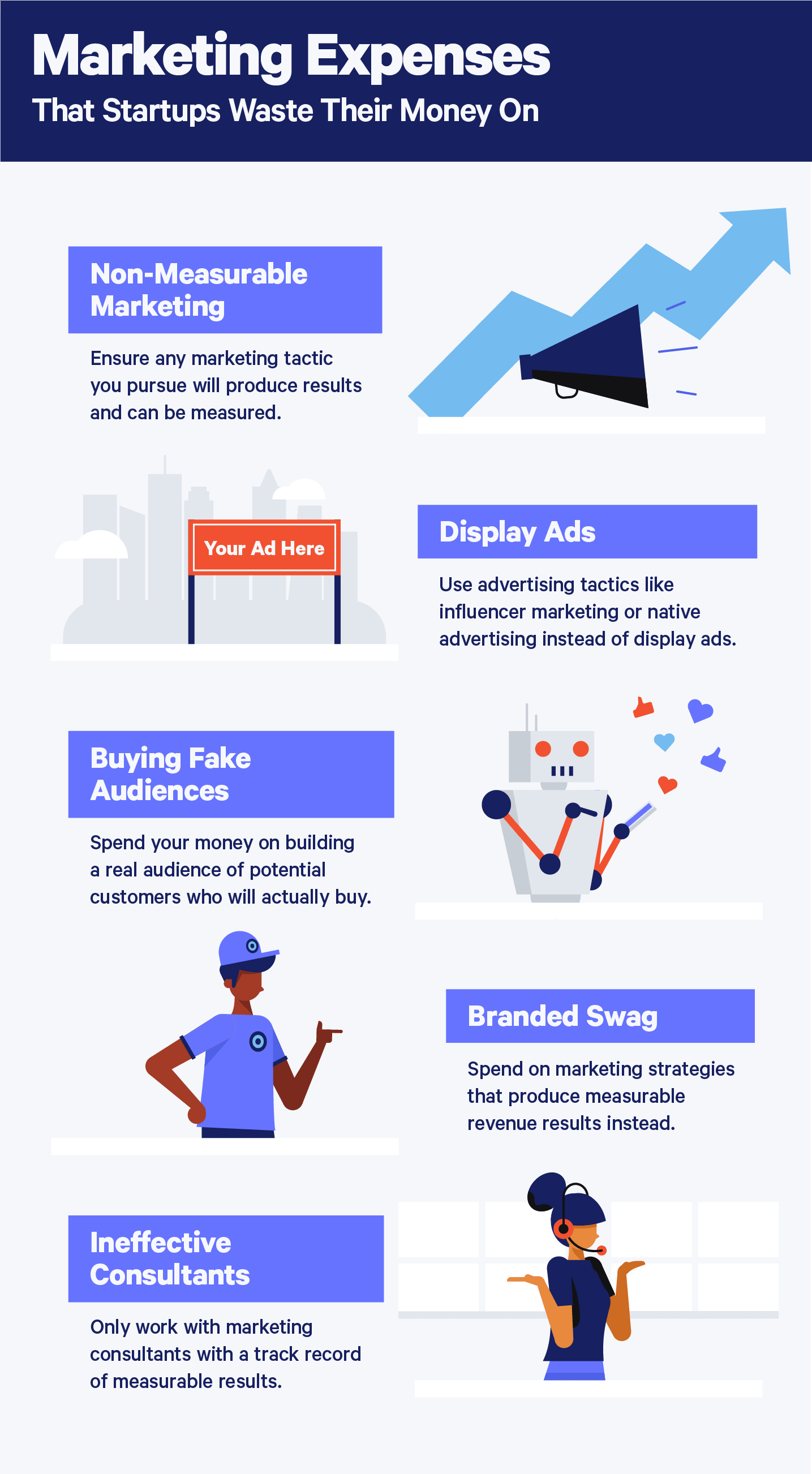

Marketing Expenses

Marketing can account for up to 20% of a startup’s business expenses. But not every marketing expense generates additional revenue (or profit). Here are 5 things to look out for that drain your funding but do not provide a return.

12. Non-Measurable Marketing

When you’re starting a new business, customer acquisition is a big priority. It’s also a huge challenge because you’re often trying to define product-market fit for the first time.

Unfortunately, this means it’s easy to spend a lot of money very quickly trying everything and anything to bring in sales (a problem because you have a finite amount of money to do so).

That’s why any marketing strategy or tactic you pursue should produce results that you can actually measure. You must ensure what you’re doing is actually providing the ROI you had hoped for. Otherwise, you may spend more to acquire customers than you realize.

Tip: Only Pursue Marketing You Can Measure

Not only will measurable marketing help you make the most of your limited resources, but it will also provide you with a baseline you can use to improve upon. The data from your initial marketing efforts will help you understand what worked and what needs improvement, so that you can become more efficient over time.

This is what helps you identify strong product-market fit and it will even help you improve your product or service over time.

13. Display Ads

Many startups will spend big on display ads, thinking they will drive brand awareness (and sales). They do to some degree, but not to the effect that most startups think they do.

Studies have found that only 35% of people actually look at display ads and that only 4% give them more than two seconds. Furthermore, they usually have incredibly low conversion rates…the highest you can expect is around 0.06%.

Simply put, they’re not a great choice for startups looking to acquire customers. The ROI just isn’t there.

Tip: Use Native Advertising or Influencer Marketing

There are other more effective advertising methods you can use to drive brand awareness and sales, such as Influencer Marketing or Native Advertising. Native ads receive 52% more views than display ads and influencer marketing converts at about 2.55% according to a study by Grapevine.

However, if you do wish to pursue display ads, they work best as a retargeting strategy rather than as a point of first contact.

14. Buying Fake Audiences

It’s no secret that you can buy fake followers for your social media profiles (you can even buy fake likes). In fact, some think that nearly half of the people who followed 2016’s presidential candidates during the election were fake.

Clearly, there must be some benefit to having them, right?

It might make you feel good, but the reality is, fake followers will never buy. Furthermore, metrics such as likes, followers, etc., are all vanity metrics. Just because you have them (even if they’re real), it doesn’t mean more sales.

Tip: Spend Your Money To Acquire A Real Audience

Simply put, it’s measurably better to spend your money on measurable marketing tactics that build a real audience rather than trying to artificially inflate your vanity metrics. Focus on what grows your sales, not your popularity (the two are not always the same).

15. Branded Swag

There actually is evidence that swag increases sales. So why is it on a list of unnecessary business expenses? For the same reasons, lavish employee perks aren’t a great tactic for recruiting talented employees: there are cheaper, more effective ways to achieve the same results for businesses on a budget.

Tip: Focus On The Needs of Your Customers

Swag is great because you’re giving something away to prospective customers and that makes them feel good. But when you’re tight on cash, it’s better to give them things that don’t cost you money (and are more valuable).

Ultimately, your goal is to delight your customers with your product and tactics like these will help you do so while also costing you significantly less in the short term. So focus on giving your knowledge away to your customers or offering them your product for free in exchange for feedback and data on how to improve it instead.

16. Ineffective Consultants

When you’re contracting work out, it’s important to be very careful about who you choose to work with. Far too many consultants or service companies will be quick to take your money off your hands but provide little value in return and startups fall into this trap regularly.

Tip: Focus on Their Results

Consultants you want to avoid will provide vague advice and little proof that it works. Those worth hiring will always set realistic expectations of what your business can achieve and have a track record of providing those for other businesses too.

How to Create a Sustainable Growth Strategy

Sustained success in the startup world is a difficult thing to create. So we studied businesses that have achieved that success (as well as those who haven’t) and wrote up what we learned on our blog. Or, learn more about how to build a sustainable growth strategy.