New Embroker report explores if SMEs, startup founders are prepared for modern risks

Protect your business today

Tell us a little about your business and we’ll create a coverage package that fits your needs, with a price you can count on.

Get a QuoteGiven Embroker’s focus on industry-specific coverage, like our Embroker Startup Package, we wanted to explore the awareness and preparedness among startup founders and small-medium enterprise (SME) owners when it comes to today’s modern risks. In a new report, Big Risks for Small Businesses, Embroker surveyed over 500 SME owners, CEOs, and tech startup founders in August 2021.

The report reveals gaps between owners’ and founders’ perceptions of risk, and what they’re doing to mitigate risk. In some cases, they are adept at protecting themselves from that risk. In others, they’re dropping the ball.

The report shows that in a time of strong growth and VC-funding for many businesses and startups, SME owners, CEOs, and technology startup founders are falling short in both evaluating risks and showing the right acumen for risk management. However, there are modern risks that threaten to get in the way of the growth many businesses are experiencing.

For example, SME owners and CEOs show little concern, almost dangerously so, for increasingly common threats such as cyber attacks. There are other examples of indifference or lack of diligence for risk transference, such as reviewing and updating policies annually, working with experts to analyze and identify risk, and even knowing how much they are paying for business insurance.

When asked about the risks and liabilities to their businesses, owners cited their top three risks as:

But, when asked about the top three areas of focus on their overall business, owners and founders identified a different set of issues: customer retention and growth, generating demand, and managing costs.

Disparities like these are common in the report, highlighting the continued importance of insurance literacy among the business community.

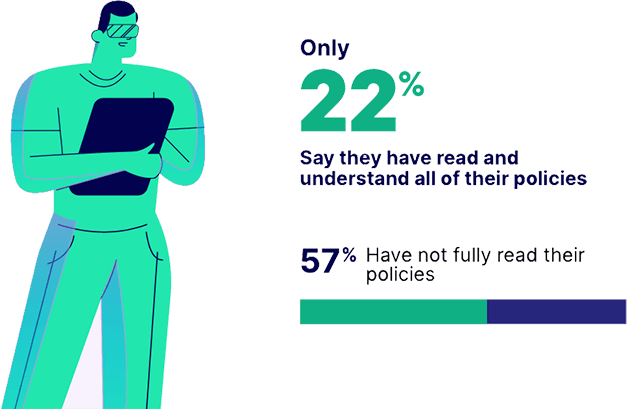

When it comes to knowledge of policies, the report shows only 22% of those surveyed have read and understand their policies, and 56% say they do not know the exact cost of their business insurance. The report also notes different levels of engagement in the process – 1 in 5 admitted to not knowing how their insurance purchases are handled.

Lagging knowledge of their policies and risk assessments is also leaving business leaders and tech founders vulnerable to many rapidly emerging risks. Namely the growing risk of cyber attacks: for businesses of any size, it’s not a matter of if, but when an attack will happen.

As business threats intensify, both owners (46%) and tech founders (57%) fear they don’t have sufficient insurance coverage in the event of a ransomware attack. But, surprisingly, the concern about this risk remains low: 63% of SME owners believe they are unlikely to face a data breach or ransomware attack.

The Big Risks for Small Businesses Report digs deeper into these and other issues, including how businesses approach enrollments and renewals, who they turn to for expertise, and if they are taking into account the everyday risks that may impact their business. Overall, the report sheds much-needed light on the underprepared, overworked, and underinsured world of SMEs and tech startups.

To learn more about the business insurance approach for SME owners, CEOs, and tech founders, download the full report.