Certificate of Insurance (COI)

A certificate of insurance proves to potential business partners and customers that your business is properly covered with the right insurance and that it is safe for them to do business with you.

Need Business Insurance?

Already a customer?

What Is a Certificate of Insurance (COI)?

A certificate of insurance is often requested in the case of a project or job in which liability concerns and the possibility of great financial losses are very real. In such a case, your client or partner will request a COI from you to prove that certain liabilities will be covered by your insurance program.

A certificate of insurance protects both small business owners and their partners. Offering both parties peace of mind, financial protection, and a risk transfer solution, before they begin working together.

A COI essentially summarizes your business insurance coverage details. It includes the most important, basic information related to your coverage, such as the policy’s expiration date and effective date, who is covered by the policy, what type of coverage it is (general liability insurance, property insurance, etc.), and your policy’s limits.

The certificate of insurance was created in order to make it easier to show proof of insurance to your potential clients and business partners. Instead of sending them your entire insurance policy contract to see, you can send them a one-page document detailing all the most vital information related to your policy.

If you have personal car insurance, then you know that you receive an auto ID card with your insurance policy that includes all of the most essential information related to your policy. A certificate of insurance is basically the same thing. It provides your business a quick and easy way to prove that it is insured.

Why Do You Need One?

Certificates of insurance are important for both you and your partners and customers. For you, as a company that is insured, being able to provide proof of insurance makes it much easier for you to enter into partnerships and grow your business. There are not many companies or customers out there today who are willing to collaborate or work with a company that is uninsured, so from that perspective, being able to obtain a COI when needed is absolutely vital for the success of your business.

If you are submitting a bid to win a contract or job, the business that is looking to hire will usually ask that you include a COI along with your bid. In most cases, being properly insured and being able to prove that you have coverage will give you an advantage over companies bidding for the same job that might not be properly insured.

There will also be times when you will be the one requesting a COI from another company. For example, if you are a construction company that often hires subcontractors to work on projects with you, then you need to request proof of insurance from these subcontractors. If your subcontracts make a mistake that results in costly property damages and injuries and they do not have any coverage, you can easily be sued for those damages.

When you do ask another business to provide you with proof of insurance, be sure to double-check what they have provided to you. You can do so by contacting the broker or agent that issued the COI. Make sure that the name of the business that you are working with matches the name on the COI. It’s also a good idea to take a look at the effective and expiration dates that are listed on the COI to make sure that the company will be covered for the duration of their cooperation with your business.

Another instance in which you need a COI is when you are audited. A certificate of insurance is needed to avoid paying premium on your general liability and workers compensation for your employees’ sales and payroll.

Who Needs a COI?

The answer to this question depends on what role your company is playing in cooperation with another company. For example, if you run a restaurant and cooperate with a company that provides you with meat products, you’re going to want to make sure that they are insured.

Why’s that? Because if they are not insured and they sell you spoiled meat that leads to your patrons becoming ill and filing lawsuits against you, your insurance is going to have to cover all of the damages.

Just the same, if your restaurant is hired to cater an event, the person or organization hiring you is going to want to know that you are insured before signing the contract and giving you the job and will probably request a COI.

Requesting a certificate of insurance doesn’t have anything to do with trust. It’s all about minimizing risk and making sure that you are covered if something happens to go wrong. Even if you trust the company you are collaborating with and you have worked with them many times, you should still make sure to ask for a COI every time you sign a new contract or agreement with them. This allows you to avoid a scenario in which you are taking unnecessary risks for the work that your partner company has been hired to perform.

What Is an Additional Insured?

There are several different entities that are named in a certificate of insurance, which is why it’s important to know the difference between each of them. Obviously, the person or business that purchases the policy is referred to as the policyholder.

The certificate holder is the person or entity that requested the COI and is in possession of it. These two are pretty self-explanatory. Another entity you’ll see regularly on a COI is called an “additional insured.”

An additional insured is a person or business that benefits from another entity’s coverage in some way. One of the most common ways is that the additional insured is often able to make a claim under a policy that they did not purchase.

It’s common for a certificate holder to request to be named as an additional insured on the policyholder’s policy.

A term that you’ll commonly see on a COI is “blanket additional insured endorsement,” which means that the policymaker has purchased an endorsement on the insurance policy that provides automatic coverage for any party that is named as an additional insured on the policy.

Basically, an additional insured endorsement on your policy will provide coverage for parties that you are working with you. Businesses, especially larger ones that have leverage in negotiations, will often ask to be named as additional insureds on your insurance policies so that they are protected by your policy in the case that a claim is filed against them or in relation to something for which they were responsible.

How Much Does a Certificate of Insurance Cost?

It actually costs nothing to obtain a certificate of insurance, because this is a complimentary service offered by the company that sold you your business insurance. If your broker is charging you a fee for providing a COI, it’s time to change your broker.

However, if the job in question requires additional coverage that your policy does not meet, then you might have to pay an additional premium to cover those costs. Other than that, your broker should never charge you a fee for providing you a certificate of insurance, no matter how many you need.

How Do You Obtain a COI?

If you need to request proof of insurance from your insurer, these are the usual steps you’ll need to go through:

- First, ask your client that is requesting the COI what the minimums and limits of the coverage should be. Get your client’s name, address, and tax identification number as well in the case that you have to increase your premium.

- Call your broker, explain to them what the minimum coverage amount is and that you need proof of insurance. If your policy already meets the requirements, then the broker will contact your carrier to secure the COI. If you need to purchase a rider to increase coverage for the project, your broker will give you the details and the paperwork you will need to fill out and submit.

- Once you’re all set, your broker will create the COI and send a printed certificate of insurance to you, after which you will have to send it to your client in order to complete your transaction and sign your contract to start your collaboration.

While the process is fairly easy to understand, it must be noted that actually obtaining the certificate of insurance from your broker could take a few days or even weeks, depending on how easy it is to get a hold of your broker and how quickly he or she is able to complete all the necessary paperwork and provide you with your COI.

Embroker’s COI Solution

Despite the fact that certificates of insurance are so vital to many business processes, obtaining them from a traditional broker is often a slow and cumbersome task that could take days to complete.

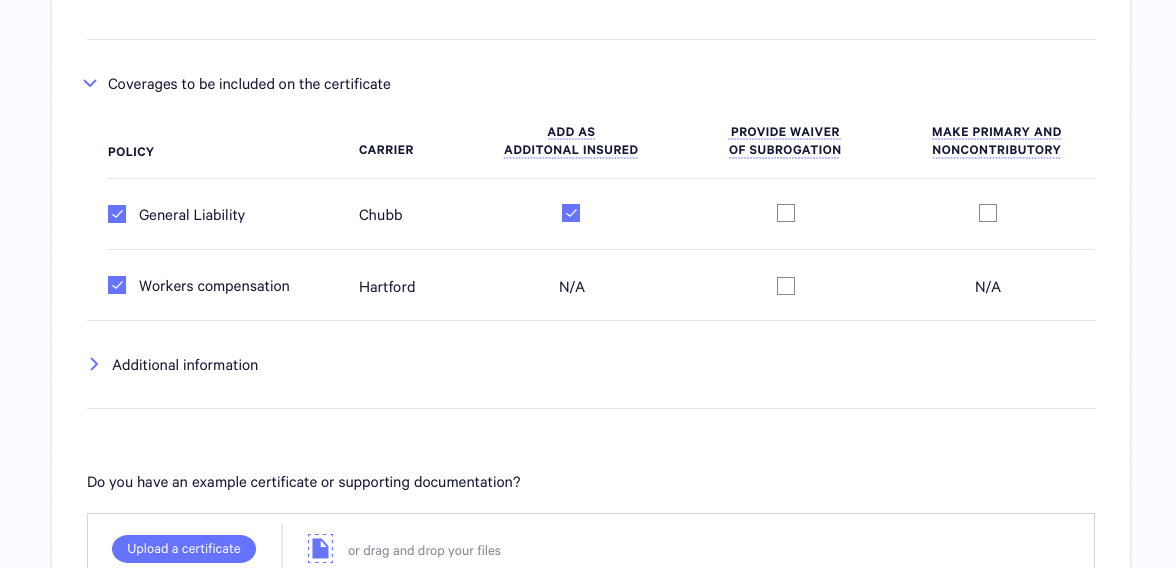

In order to increase the speed and ease of obtaining a certificate of insurance, Embroker has developed a way to put businesses in control and avoid having to play a game of phone tag with their brokers in order to obtain a COI and send it off to their partners or clients.

Wouldn’t it be great if you didn’t have to depend on your broker and wait days to receive your proof of insurance? Embroker allows you to do just that. We enable you to quickly create and request your own COIs right from the platform, potentially saving you days, if not weeks, of unnecessary back-and-forth.

Our team puts together the certificate of insurance and sends both you and your client an industry-standard PDF (ACORD 25) that you will be able to download, print, and store in your Embroker account.

Most COIs can be sent instantly through Embroker and even the most complex COIs will be completed and sent within 24 hours.

On top of that, Embroker also enables your clients to request certificates on their own through our website. We prepare the COI based on your needs, listing types of insurance coverage, additional insured, special requirements and wording, etc., and let your clients and partners request the COI independently.

Sign Up in Under 10 Minutes

“Embroker has given the insurance industry a much-needed makeover that transforms something I always considered monotonous and dull into something streamlined and simple.”

Axon Optics

Don’t Just Take Our Word for It!

With a Net Promoter Score (NPS) of 71 Embroker ranks above the insurance industry average.

NPS Score 2023