Startup Equity Calculator: How to Split Fairly Among Founders

Our startup equity calculator eliminates guesswork to help cofounders determine how to divide ownership of their company fairly. Calculate now.

When you and a partner or partners decide to launch a startup, you need to determine how much of the company each of you will own. While splitting things equally might sound fair, that’s only the case if all founders are contributing the same amount — not just in funding, but in time, ideas, intellectual property, business relationships, and more. If not, you need a system that will split equity fairly according to what each founder contributes.

Our startup equity calculator is designed to help quantify each of a startup’s co-founders’ contributions in order to more accurately split equity in the company so you can prevent disputes between team members and focus on what matters: getting your company off the ground.

Calculate Your Co-Founder Equity Split

Check the boxes of each founder who contributed to the effort mentioned in each question. If two or more founders contributed, rate each founder's contribution on a scale of 1-5; 1 being the lowest contribution and 5 being the highest contribution.

Results

Based on the answers you gave, your equity split should be:

Types of Contributions

Founders contribute different amounts, but they also contribute in different forms. Far from comparing apples to apples, tallying founders’ contributions is like comparing apples, oranges, pineapples, bananas, and coconuts – and converting it all into fair equity shares.

As you’re dividing your equity, consider the following types of contributions.

Knowledge

Knowledge is one of the most valuable assets that founders can bring to the table. Different types of knowledge take different forms.

Industry-Specific Expertise

One or more founders must have intimate knowledge of how your startup’s product or service works. Without this knowledge, your startup would never get off the ground. No matter how efficient the rest of your operation, without industry expertise, your startup has nothing to sell.

Typically the industry expert is also the person who came up with the original idea, which merits consideration in the equity split as well.

Business Knowledge

Startups with a business-oriented founder and a founder who’s an industry expert fare better than those with just one founder or multiple founders with the same type of knowledge. A founder who brings expertise in running a company or, better yet, building companies from the ground up, is just as valuable as the founder with intimate knowledge of how your startup’s product works.

Marketing & Growth Knowledge

Particularly in the early stages, leveraging relationships to gain funding, resources, and talent is a critical factor in determining the startup’s future success. Founders who bring previous relationships with key industry contacts, potential investors, and journalists should be compensated for this contribution in the equity split.

Commitment

Founders that risk more to commit fully to your startup should benefit from that risk. The more skin you have in the game, the more equity you should earn.

Time Commitment

The most quantifiable way to measure commitment is in hours. How many hours per week is each founder dedicating to working on your startup?

Be sure to place a limit on the point past which the number of hours worked won’t affect your equity split, in order to avoid incentivizing founders to overwork themselves. If you and your co-founders typically work 30 and 60 hours, respectively, that should be reflected in your equity split. However, continuing to offer more equity as founders get into the 70-80 hour range will only encourage burnout.

Full-Time or Part-Time Job Commitment

While job commitment is closely related to time commitment, what you should consider in this section isn’t the hours spent working for your startup — it’s the opportunity cost that each founder pays by not spending those hours elsewhere. For example, a founder that leaves a stable, well-paying full-time job in order to work at their startup has a much higher opportunity cost than a founder who splits their time between the startup and part-time work. A founder whose investments can support them without the need for a salaried position puts the least at risk by choosing to take on the work of launching a startup.

Geographical Commitment

Did any of your founders relocate in order to be closer to your office, other co-founders, or potential investors? Is one of your founders taking on the lion’s share of the physical travel required to take in-person meetings with potential directors, officers, or board members? In addition to reimbursing company travel financially, the stress and burden of travel or relocation should be reflected in your equity split.

Equipment

Finally, founders that provide necessary materials, equipment, or resources should be compensated for that contribution. It’s up to you which contributions will be reimbursed financially from company funds and which will be reflected in your equity split.

Physical Equipment

If any of your founding partners provided necessary equipment for your team, that should be considered in your equity calculations. Individual tools like one-time software purchases or a printer for your office can be paid out monetarily, but if a founder contributes something major — company vehicles, staff electronics, etc. — that should be a factor in determining equity.

Online Resources & Subscriptions

You may be surprised at how quickly the costs of necessary online platforms and tools can add up. Things like Adobe Creative Cloud, accounting software, tax filing software, project management platforms, web hosting and domain purchases are not only expensive, but they require effort to keep organized. Whichever founder takes on the work of purchasing, subscribing, maintaining, and renewing your company’s subscriptions should be compensated for that work — especially if they’re fronting the cash for each purchase.

Office Space

You probably won’t have an office right away, and in some all-remote cases, you may not need an office at all. However, many startups begin their early days in an informal working space, like a spare room in someone’s home or an extra office space at a founder’s place of business. The contribution of workspace, whether it’s at home or in the office, should be a considered factor in splitting equity.

Founders vs. Investors

You’ll notice that the calculations above do not account for any initial capital contributions by founders. This is because monetary contributions should be treated as investments, not leverage for determining founder equity.

Founders’ equity is measured in common stock, which is stock that affords owners voting rights in the company. Investors are paid in preferred stock, and therefore receive dividends before common stockholders but do not receive voting rights in the company.

Rather than incorporating monetary contributions into the initial founder equity split, treat founder investments like an early series seed round and issue preferred stock separate from the common stock divided among founders.

Setting a Vesting Schedule

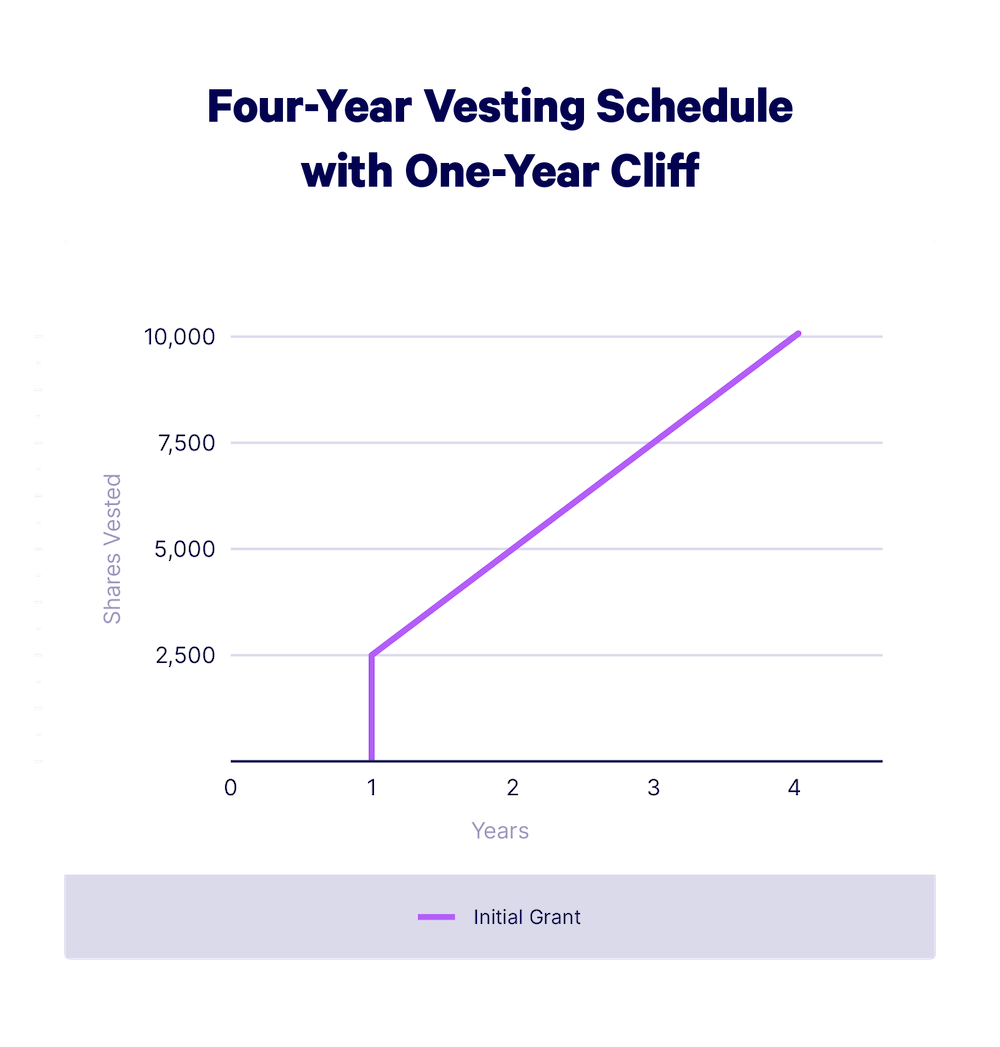

Another key element of equity splits among founders is the vesting schedule, which prevents equity shares from becoming fully mature for a certain period of time in order to ensure the founder remains with the company long enough to justify their portion of the company’s ownership.

Traditionally, Silicon Valley-style startups employ a four-year vesting schedule with a one-year cliff, meaning that zero of the founder’s shares will vest until the one-year mark is passed. At the one-year mark, one quarter of the owner’s shares will vest, and the remaining shares will vest on a monthly basis until the full vesting period is over.

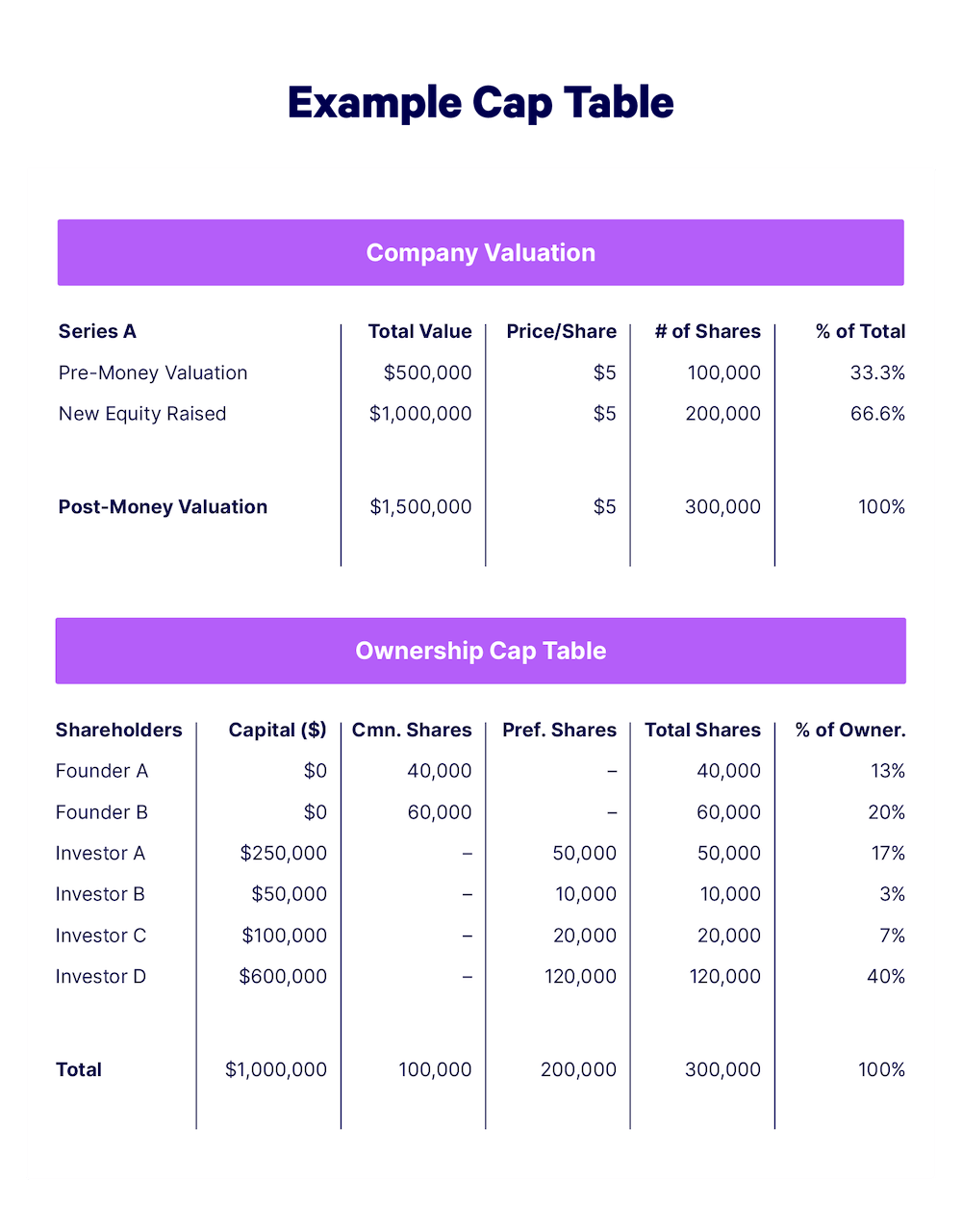

Drawing a Cap Table

Cofounder equity shares are just the first of several ownership issuances that your company will undergo throughout the startup process. As you move through funding rounds and employee hires, you’ll issue shares to investors, venture capitalists, private equity firms, employees, and more.

A capitalization table keeps track of all a company’s securities as well as who owns them, the prices paid, and how many outstanding shares remain to be issued.

As you progress through funding rounds, your cap table will become increasingly complicated, so it’s important to keep it up to date and accurate at all times. Should your company fail, investors may attempt to sue in an effort to recover their losses. In addition to insurance designed to protect against exactly these types of lawsuits, keeping detailed records is one way of protecting yourself in case of a lawsuit later on.