What Insurance Policies Do Freelancers Need?

Freelancers are essentially small business owners. Learn about freelance insurance and the policies that you need as an independent contractor.

Protect your business today!

Get a QuoteDo you know the policies associated with freelance insurance? With more people paying greater attention to work/life balance and seeking to find ways to turn the process of earning money into a more flexible endeavor, the number of people choosing freelance careers over traditional employment is constantly on the rise. In fact, a recent survey published by Upwork claims that a majority of American workers will be freelancing in some way by 2027.

And while you can be a freelancer in just about any profession, working independently as a doctor, accountant, or plumber, for example, the first thing most people think about when they hear the term is “computer jobs,” namely IT professionals and software developers who can literally work from anywhere and at any time, as long as they have a good Internet connection.

Even if the general impression sometimes is that freelancing is a glorious lifestyle that allows you to travel the world and sit in coffee shops all day, the fact of the matter is that it’s still serious work. Remember, being a full-time freelancer means that you are a self-employed entity, which legally makes you a small business owner.

If you are a full-time freelancer, that means that you are paying your own Social Security and taxes. It also means that you are the only person that can be held responsible for a problem if the work that you have provided has caused damages or losses of any kind to your clients.

That’s why, just like the owner of any other business, you should be protecting yourself as a freelancer with the right freelance insurance program. So if you’re thinking about leaving the corporate world in order to gain the freedom and independence of work that comes with being a freelancer, or you’ve already done so recently, you’re going to have to learn about how to protect yourself, your business, and your assets with the proper freelance insurance.

Why Freelancers Need Insurance

No matter what type of work you’re doing as a freelancer, every profession comes with a particular set of common risks. If you are an IT freelancer, you are going to have to protect you and your client from the fallout of possible cyber attacks that could lead to data theft.

As discussed earlier, businesses and freelancers alike can face claims if their customers believe they have lost money as a direct result of the work that a freelancer provided or if clients believe that contractual obligations have not been met.

Furthermore, you might find it incredibly hard to find work as a freelancer if you don’t have any insurance since a majority of potential clients will ask to see a certificate of insurance before signing a contract and agreeing to work with you. The number of freelancers out there in all industries is increasing and not having the right coverage could disqualify you immediately in the eyes of many customers.

Conversely, having a quality insurance program as a freelancer makes you more attractive to potential clients and lets them know that you are looking out for both your best interests and theirs.

Furthermore, having insurance doesn’t just increase your chances of making money as a freelancer, it decreases your chances of losing money as well. While larger companies might have enough money to recover from an expensive liability or malpractice claim, most freelancers certainly do not and will most likely end up financially crippled if they don’t have the help of insurance in the event of an expense claim being filed against them.

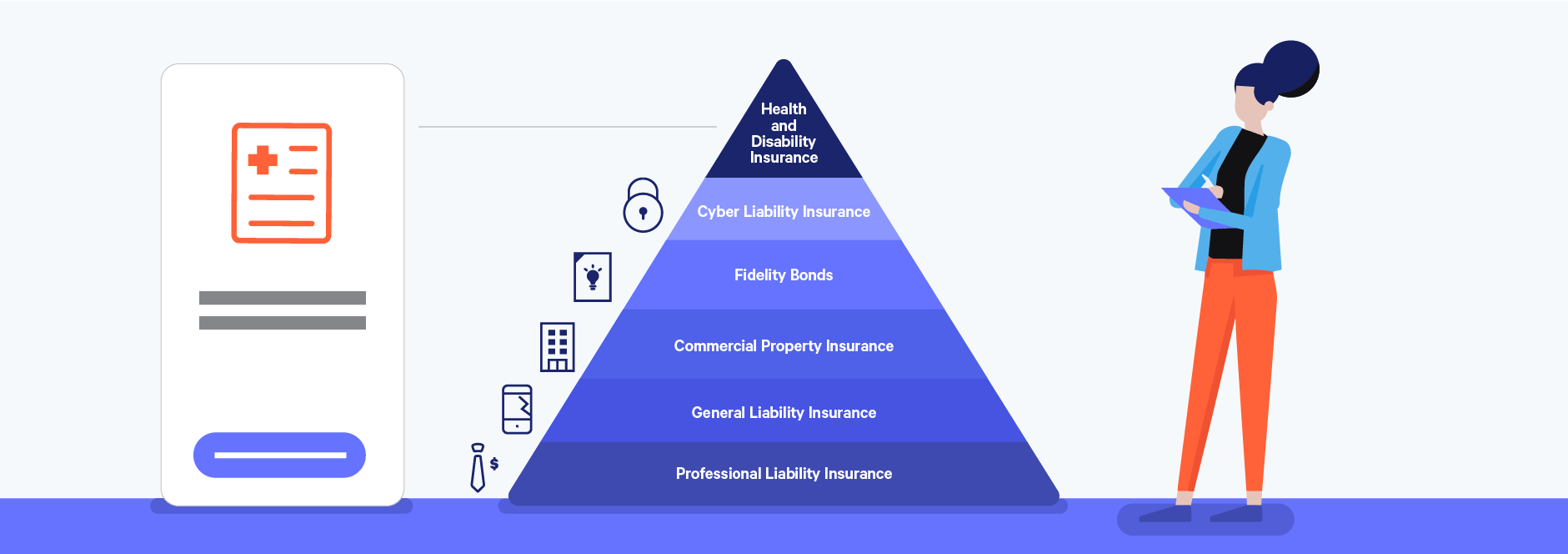

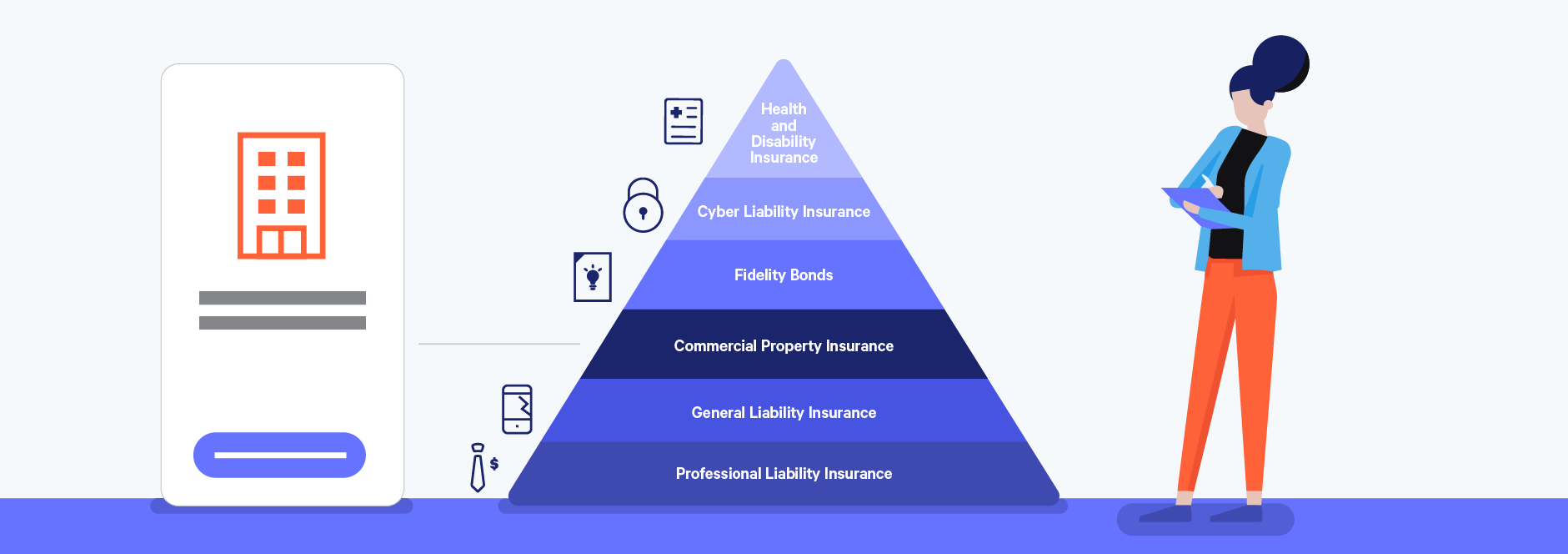

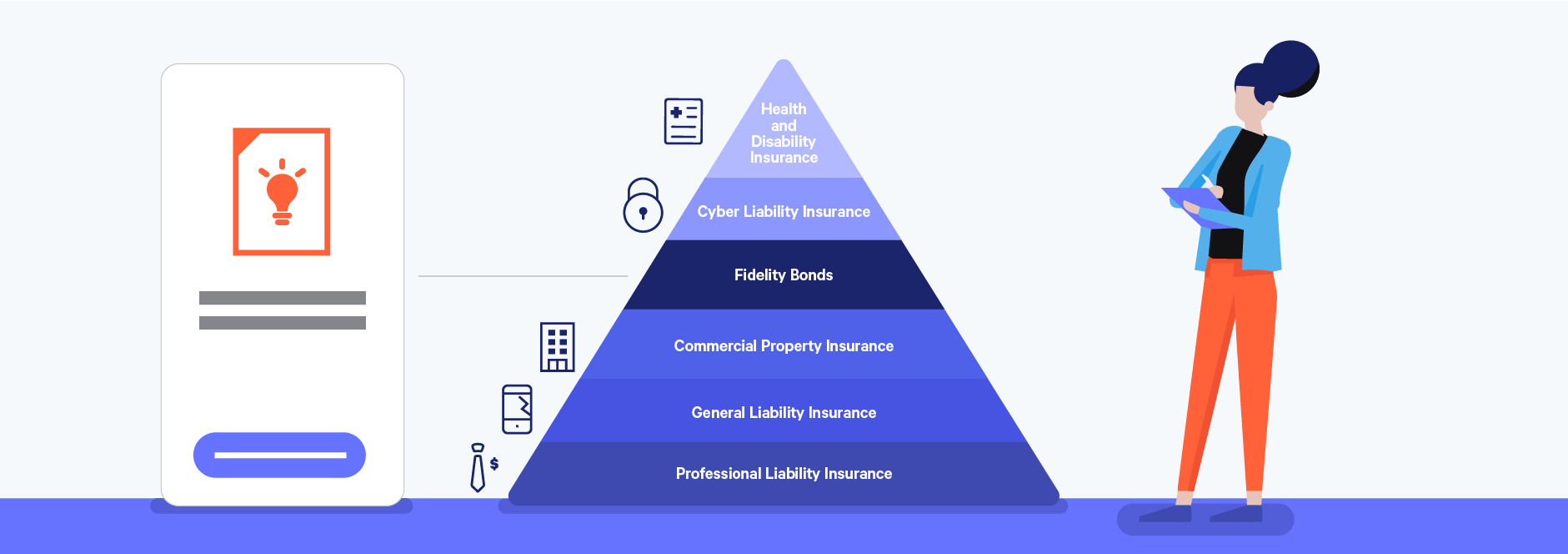

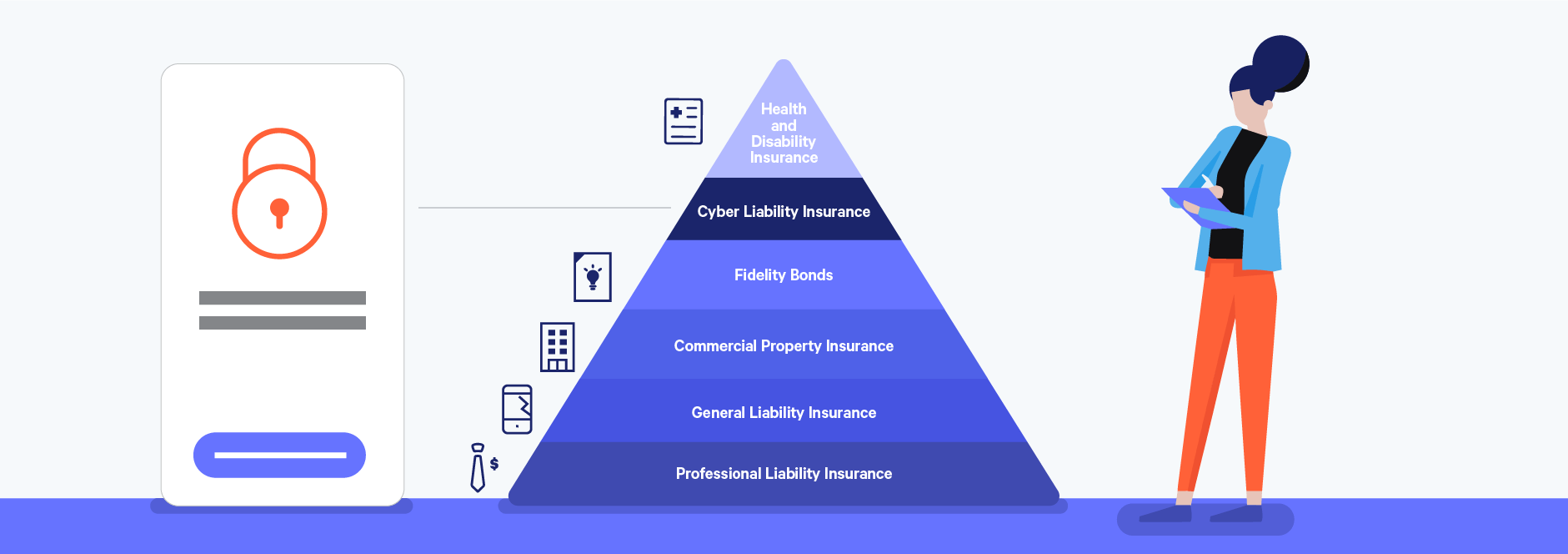

Identifying Key Freelance Insurance Policies

Obviously, the coverage that you will need to buy will depend on your profession and what type of freelance work you are performing. However, there are a few policies that just about any freelancer should have in order to protect him or herself from costly lawsuits that could arise from some of the most common risks that freelancers face on a day-to-day basis.

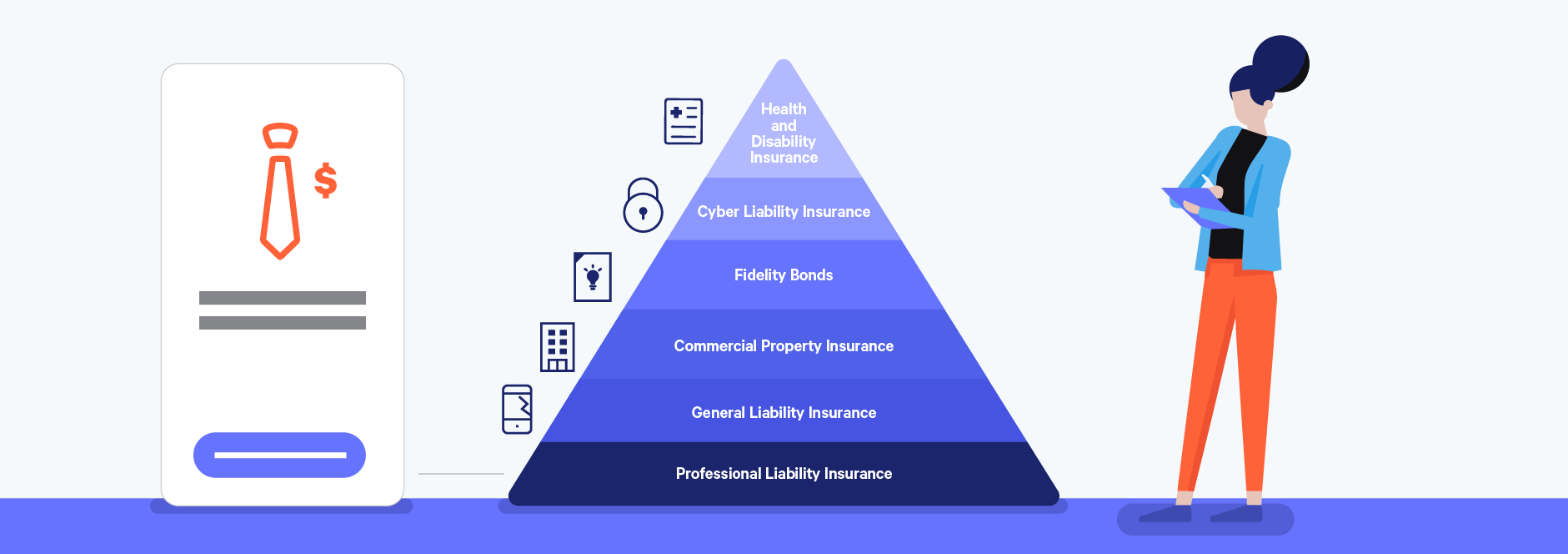

Professional Liability Insurance: This is probably the single most relevant insurance policy for freelancers since anyone who provides any type of professional services should have professional liability insurance, also known as errors & omissions coverage. Whether you’re a programmer, designer, writer, accountant, or any other participator in the gig economy offering your professional services independently, you’re going to have to protect yourself.

Professional liability insurance provides coverage for freelancers who are accused of making mistakes that affect the bottom line of their clients. For example, if you are a freelance web developer and you signed a contract stating that your client’s website would be up and running before Black Friday, you could be sued by the client if you fail to make good on that promise. Professional liability coverage would kick in to pay legal expenses and any eventual payouts related to such a claim.

General Liability Insurance: One of the first policies that most business owners will buy, a general liability policy protects you from customer injuries or third-party damages. If you are a freelancer that is renting out office space for work, you are usually required to have general liability coverage before signing the lease.

Commercial Property Insurance: Even if you are a freelancer that works from home, you might need to buy commercial property insurance, because typically, a standard homeowner’s or renter’s insurance policy will not cover damages related to your business property. This means that if your computer or other business equipment is damaged or stolen, you won’t be covered if you don’t have a commercial endorsement for your homeowner’s or renter’s policy. The safest and best thing to do is to buy a commercial property policy to make sure that all of your business-related property is going to be protected.

Fidelity Bonds: Contractors that are self-employed usually need to purchase bonds that act as a three-way agreement between you, the client, and the insurer. Most people are probably familiar with surety bonds, which are a staple of doing business as a contractor in the construction business. When you purchase a bond, your insurer will pay your client an agreed amount if you don’t deliver on what you promised to deliver in your contract between yourself and the client. If you are a freelancer in the IT industry or in finances, it’s a good idea to purchase a fidelity bond, which provides protection against fraud, theft, and data breaches for your client.

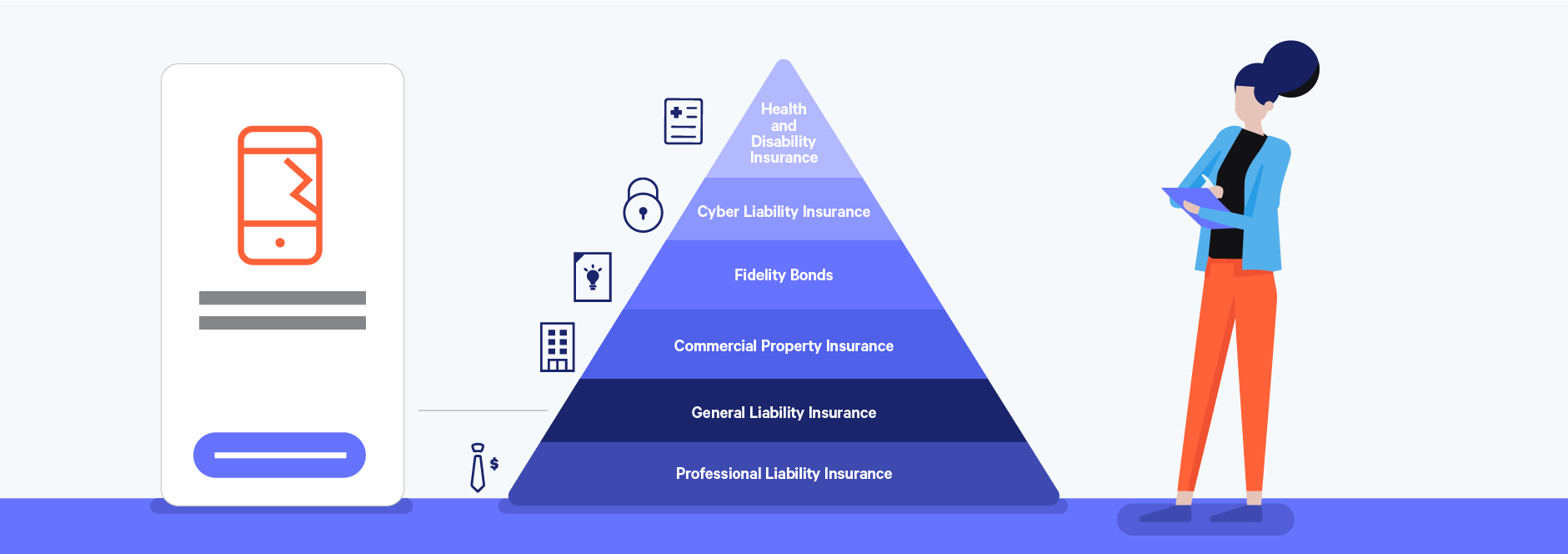

Cyber Liability Insurance: Many IT freelancers have to deal with customer data and therefore run the risk of data breaches resulting from cyber attacks. For example, if you are in charge of handling and processing credit card payments for your clients, you could be held financially liable for damages if this personal information is stolen or compromised in any way. Cyber liability insurance will cover expenses, in such cases, related to notifying clients about the breach, hiring computer forensics teams to find out how the breach occurred and what can be done to prevent such issues from occurring again, and will also pay legal fees and civil damages if necessary.

Health and Disability Insurance: According to a recent survey, 22% of freelancers say that affordable healthcare is a top concern for them since they are self-employed and do not have an employer to provide them with health insurance or any type of employee benefits plan. Not only should freelancers put serious thought into finding a good health insurance plan for themselves, but they should also consider disability insurance as well since they can’t rely on employer-implemented workers compensation insurance in the event that they suffer some type of injury or serious illness as a result of their freelancing work.

If you’re a freelancer that would like to speak to a business insurance expert in order to be certain that you are buying the right coverage for your business needs, feel free to reach out to one of our expert brokers to talk about your freelance insurance options.